راهنمای مطالعه

- Advice on registering a Turkish company in 2024

- Which jobs in Turkey require company registration?

- Types of companies in Turkey

- Private or Limited company?

- Company registration procedures (in summary)

- Company registration process (from A to Z)

- Company registration cost in Turkey

- Getting residency in Turkey by registering a company

In this article from “Istanbul Hamrah”, we aim to describe the process, current costs and managing of company registration in Turkey. First you need to know what the purpose of having a company is.

As you know, at the beginning of 2020, there will be no extension of tourist residency for foreign nationals except Europeans. One way to extend the residency is to register a company in Turkey. But what are the processes and how much does it cost to register a compancy? Is there any benefit in registering a company for the purpose of getting residency?

Advice on registering a Turkish company in 2024

The "Istanbul Hamrah" team is with you to buy property, obtain Turkish residency and citizenship, register a company and represent the top Turkish brands.

Which jobs in Turkey require company registration?

According to the law In Turkey, you must register a company to start any business. Starting a cafe and restaurant, tailoring, hairdressing, etc. all require company registration.

If you are planning to invest in Turkey, be sure to read about investing in Turkey in advance.

Types of companies in Turkey

In Turkey, you can register seven types of companies, of which two types, personal and limited, are the most widely used.

- Organizational companies (with a minimum capital of 100 thousand liras)

- Anonim companies (with a minimum capital of 50,000 lira)

- Limited Liability Companies (with a minimum capital of 10 thousand lira)

- Non-organizational companies (based on the articles of association)

- Kooperatif companies (based on the articles of association)

- Kolektif companies (No minimum capital(

- Komandit companies (No minimum capital)

Private company in Turkey

This type of company can be registered by a real person and receive a registration number and activity license. The articles of association of private companies are limited and it is not possible to include any activity. If your business does not have a wide scope of activity, we suggest registering this type of company because it costs less which is a total of about 3,000 liras. Conditions of getting a work permit is also easier for chief executive officer (CEO). The registration time of the company is done in less than a few days.

Limited Liability Companies

If your business includes more than one person and you want to start your partnership business, you must register a limited company. The liability of the company’s debts depends on the share of each person’s initial capital. The minimum capital for registering a limited company is 5,000 lira.

Private or Limited company?

In limited liability companies you can include a range of activities in the company’s articles of association. Private and limited companies each have their advantages and disadvantages, and you should look at the type of activity, the workload and the number of manpower in your program, and then proceed to set up the articles of association and register the company. It is also possible to register a limited company in 2024 with one person.

Company registration procedures (in summary)

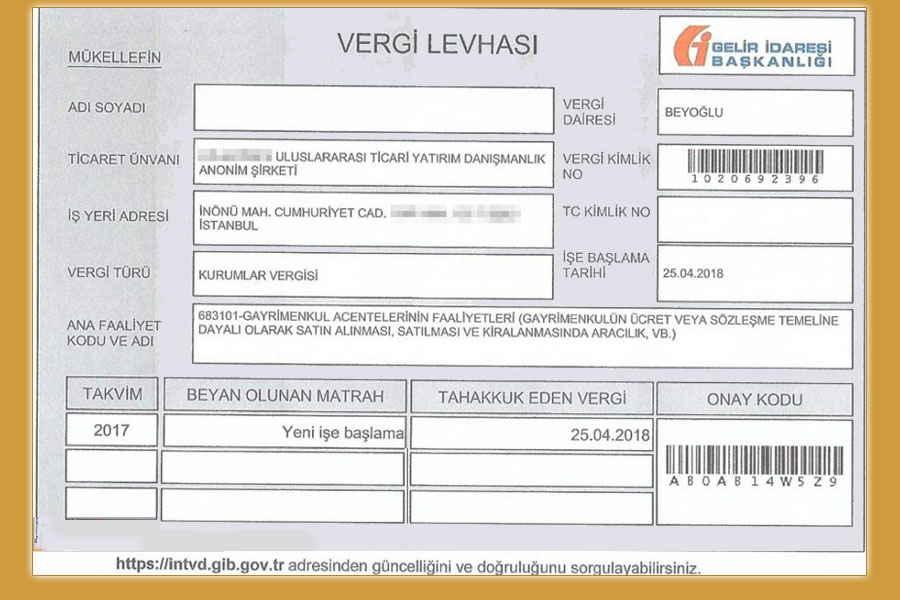

In Turkey, you must first refer to the tax office and get the tax code for the founder of the company. Then refer to the company registration office after confirmation (Noter) of the new articles of association and documents. For example, one of these documents is your office lease agreement and your address. After the documents are delivered, an inspector will be send to visit your office. After completing the documents and paying the fees, you will be given a registration code. You should also apply for a “Vergi levhasi” for your company (the picture below). And after that, the company will officially start the activity.

Company registration process (from A to Z)

- You must first translate the partners’ passports to register the company

- Choose a Turkish certified accountant for the company

- Set the company’s articles of association in Turkish

- Obtaining the tax number of the company’s shareholders from the Turkish Tax Administration

- Completing a special company registration form in Turkey

- Refer to the Turkish Chamber of Commerce and complete the relevant forms

- Set up the commitment form (Chamber of Commerce)

- Official registration of the CEO’s signature at the Civil Registry Office

- Formal approval of the articles of association at the Civil Registry Office

- Open a personal account to deposit the initial capital )Never deposit in another account(

- You must have a quarter of the company’s capital in your account

- Print the official newspaper of the company

- Prepare the lease and announce it to the tax office to send an inspector

- Obtaining the company tax number from the relevant office “Vergi levhasi”

- Obtaining a company registration card or a company business card

- Licensing of accounting offices and their opening

Company documents must be registered in the central registry system (Mersis) and some of the above documents must be sent to the business registry office.

Company registration cost in Turkey

You will also have company management costs after registering the company. These costs include office rent, the cost of accountant, and the annual cost of offices and auditing. If you get a work permit, add 1000 lira per month to these expenses. You also have to pay a monthly fee of 600 lira to accountant. You can use shared offices to reduce costs, in which case you will not have the cost of renting an office. The cost of virtual or shared offices starts from 250 lira per month.

Improper registration of the company and wrong procedure can provide many problems and debts for you and cause multiplied costs.

Also, the incorrect performance of a firm in this regard can cause tax problems and so on.

After paying the main money, such firms will request additional cost during working process, and you will have to pay them.

For these reasons, choosing the operating company and the accountant who must have a license for these services are the most important part of registering a company process in Turkey.

Getting residency in Turkey by registering a company

Before taking any action, you should consider what is your purpose in registering a company in Turkey? Getting residency in Turkey is one of these goals. By registering the company, one can receive a short one-year residence permit for the CEO and his family.

Actually, there are many ways to get residency in Turkey, which in the articles, we reviewed the ways to get residency in Turkey. Company registration can also lead to getting Turkish citizenship which can be one of the main goals of living in Turkey.

World business by having a bank account and having legal personality can also be one of the goals of registering a company in Turkey.

Hiring a Turk employee

Despite of what is stated, you do not require to hire a Turk employee to register a company. Even under certain conditions, you can get your work permit without hiring Turkish employee. It all depends on how your articles of association is set up.

For example, a company that has two people in its chart does not need a Turkish employee. Or, for a company manager who needs a secretary, hiring Turkish staff will not be required.

Advantages of registering a company in Turkey

- Getting Turkish residency for the CEO and his / her spouse and children

- Getting a work permit that leads to Turkish citizenship and a passport after 5 years

- Opening a bank account in Turkey and taking its advantage.

- Other benefits you need for your exchanges and business.

- Starting your business legally.

- Getting a business card from Turkey.

Services of getting Business card

After registering a company, you can apply for your business card from the Turkish Chamber of Commerce.

Getting this card is part of the company registration service and “Istanbul Hamrah” does not receive any payment for it.

Obtaining the domain for the company’s website with the national extension .tr

By registering a company in Turkey, you can get a domain website from the Turkish government with the .tr extension in the name of your company.

“Istanbul Hamrah” will do all the steps for obtaining a domain for you.

Companies’ tax in Turkey

After registering the company, it is time to set the tax payment period. This period can be one month or 3 months. The payment method is that the company’s auditor should check your expense and income invoices.

After reviewing the invoices, the company’s net profit is determined and 18% of the income must be taxed.

It should be noted that the amount that enters the company account does not necessarily require payment of taxes and your financial advisor determines the amount of your company tax based on your performance and invoices.

Opening a company bank account in Turkey

Istanbul Hamrah, along with official negotiations with two reputable Turkish banks, including Zaraat Bank and QNB Bank, has provided the possibility of opening a company account in these banks for customers.

Opening an account for companies whose articles of associations are prepared by our experts is completely guaranteed and the accounts of all dollar and euro currencies are activated.

Istanbul Hamrah, which is an official website, has a term in its articles of association called “company registration services”, which has made company registration legal for our customers and legal services are allowed.

FAQ

Taxes are very low in Turkey compared to Europe, and you have to pay about 15% tax on net income.

Registering a company in Turkey costs from $ 800.

The tax in Turkey is about 15% of the company’s income and you have to pay the accountant cost every month.

Yes, you can submit your work permit application to the Turkish Labor Office after registering the company.